This article explores the crucial considerations regarding rental car insurance and the benefits offered by various credit cards. All information regarding credit card offers is gathered independently, and terms apply.

Should you opt for rental car insurance when picking up your vehicle at the Avis, Budget, or other rental car counters? Alternatively, does your existing auto insurance or a rewards credit card already cover this benefit? Since supplemental insurance for rental cars can range from $13 to $30 daily, it’s prudent to investigate these options before making a decision.

Understanding Rental Car Insurance Needs

It is crucial to understand your insurance needs before renting a car. If you reside in the U.S. and own a personal vehicle, your auto insurance policy likely covers rental cars in the U.S. However, some states, such as Florida and New Hampshire, may have more limited coverage requirements. If your personal auto policy lacks collision and comprehensive insurance, your rental car could be underinsured in case of an incident.

Additionally, many top travel credit cards may offer rental car coverage for international trips, but there could be exclusions. As such, contacting both your credit card issuer and your auto insurer before rental is advisable to confirm coverage updates or changes.

Do You Need Extra Rental Car Insurance?

Before you decide on additional insurance for your rental car, consider whether you really need it:

- Lower Value Cars: If you drive older, less valuable cars, additional insurance may be a wise choice for rental cars, which tend to be newer.

- International Travel: Renting a car abroad often necessitates additional coverage.

- Business Travel: Personal insurance does not cover rented cars for business purposes.

- Low Coverage from Personal Insurance: If your personal policy provides minimal protection, opt for a credit card with beneficial rental car insurance.

- Prevent Premium Increases: Utilizing credit card coverage can prevent your personal auto insurance premium from rising in case of an at-fault accident.

Comparative Analysis of Credit Card Rental Car Insurance

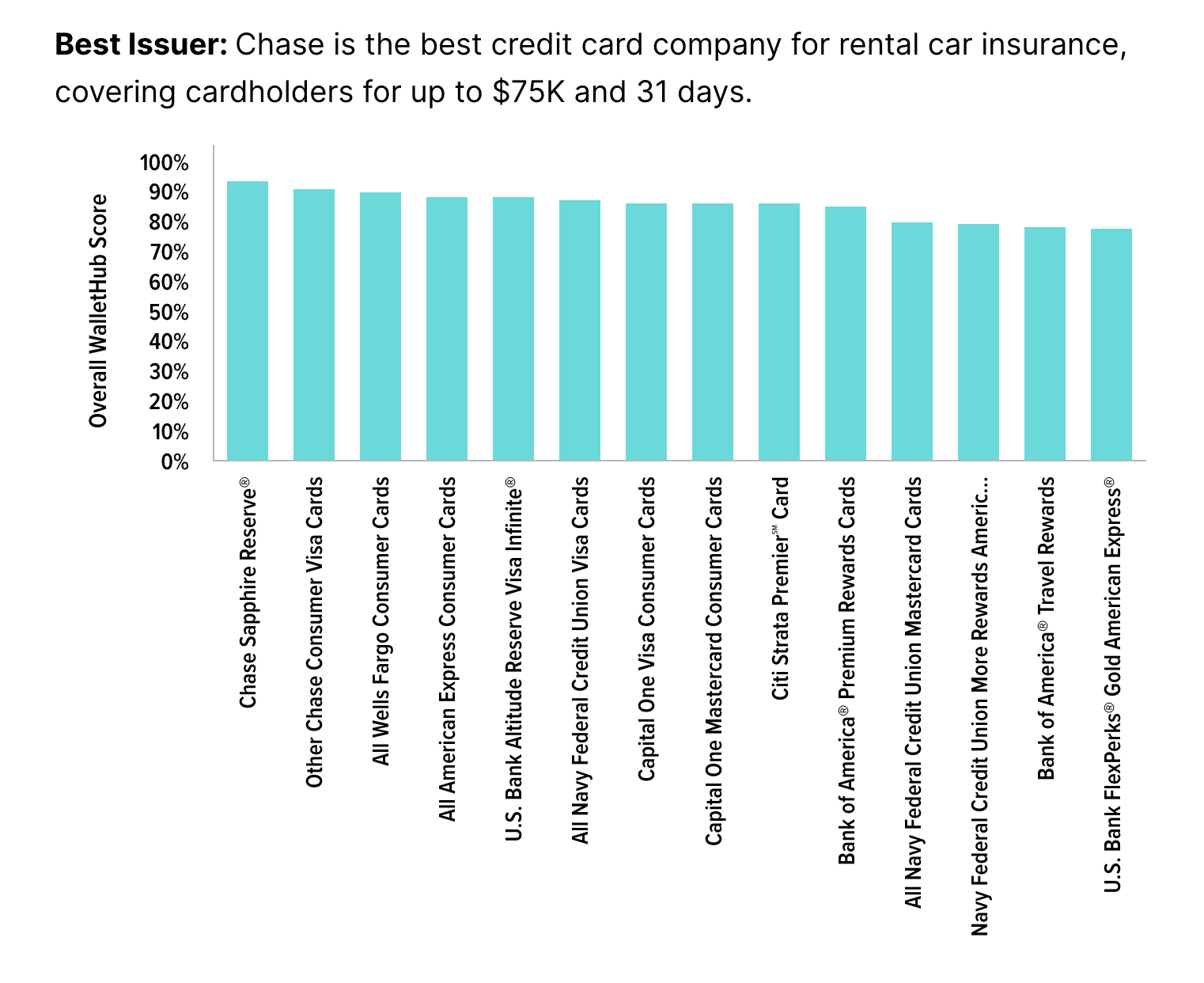

Multiple banks, including Bank of America and U.S. Bank, offer varying levels of rental car insurance benefits. Therefore, it is important to understand specific terms for each card. Chase Bank, in particular, has been noted for providing outstanding rental car insurance benefits, as highlighted in various studies comparing credit card offerings.

Best Coverage Among Credit Cards

Chase leads the pack, providing comprehensive global rental car insurance—this includes countries where other cards may exclude coverage. Chase also offers a high coverage amount (up to $75,000) and extends coverage duration (up to 31 days) compared to many competitors.

However, Synchrony and Discover credit cards do not provide rental car coverage, making them less ideal for this particular need.

How to Utilize Your Credit Card for Rental Car Insurance

Using your credit card for rental car insurance is relatively simple. When reserving your rental car, use the appropriate credit card and decline the rental company’s theft and damage insurance. Ensure that you pay for the rental with the same card to ensure coverage.

Ways to Miss Additional Fees

Maximize your savings by noticing and avoiding common rental car fees that may offset your savings. For example, consider using rideshare services or public transport to avoid airport fees. Refueling before returning the vehicle can also help you sidestep high refuel costs. Moreover, bringing your own toll transponder can save you from daily transponder rental fees. These measures encourage efficient spending during your travel.

Disclaimer

This article is independently compiled to guide informed financial decisions, reflecting an objective view of rental car insurance and credit card coverage without endorsements from any entities.