The Rising Costs of Car Insurance

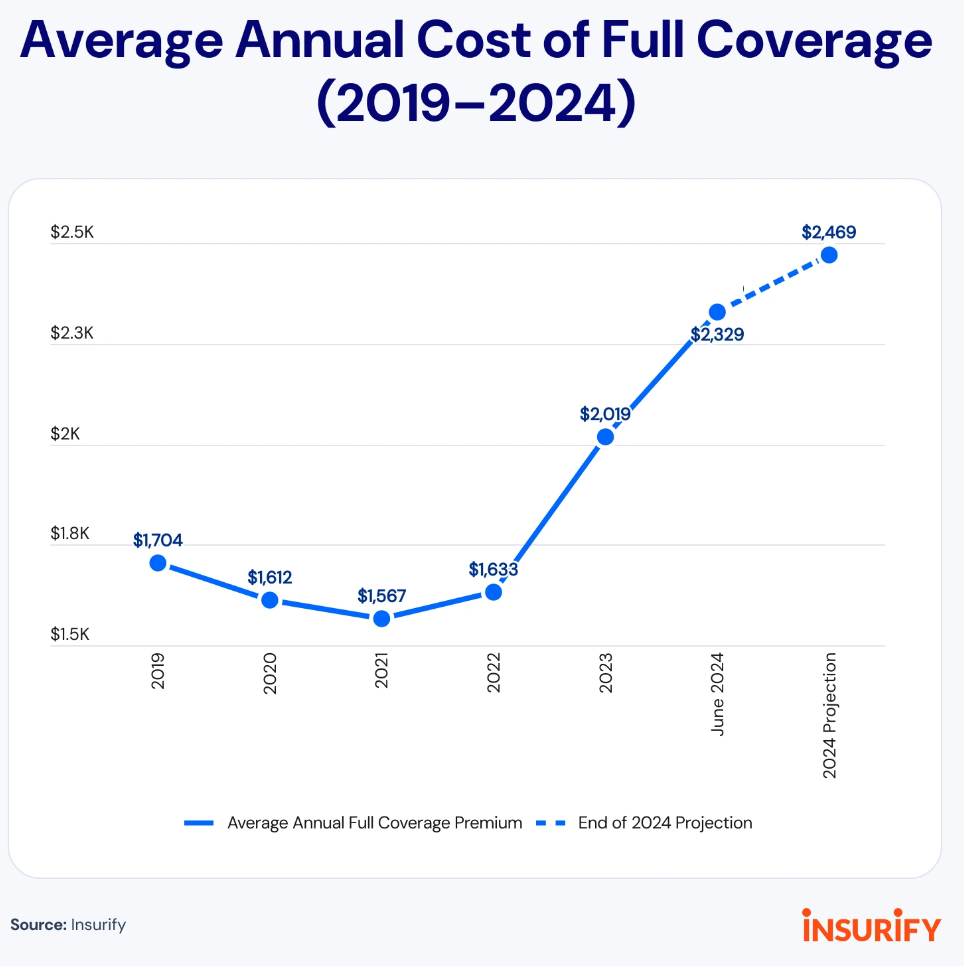

If it seems like car insurance rates are through the roof, it’s not your imagination. The cost of full coverage car insurance increased 15% in the first half of 2024, despite experts predicting a slowdown in rate hikes. In 2023, car insurance climbed 19% compared to the year prior, marking the biggest yearly increase since 1976. Moreover, this year, insurance coverage in three states could increase by more than 50%.

According to available data, the yearly average full-coverage premium is now $2,329. New Hampshire drivers pay the least for car insurance, at an average of $1,000 annually, while Maryland has the highest car insurance costs, with an average full-coverage rate of $3,400 annually.

Some of the most and least expensive states for car insurance may surprise you. Below, we outline the factors driving the increase in car insurance rates and provide steps you can take to lower your costs.

Factors Driving Car Insurance Increases

Although types of car insurance vary from state to state, nearly every state requires drivers to have some form of liability coverage. Comprehensive and collision coverage are optional in every state. However, as many as one in seven, or 32.7 million people, drove without car insurance in 2022.

Several factors are contributing to the rising costs:

- Vehicle maintenance and repair costs have surged by nearly 38% over the past five years. The sophisticated technology in modern vehicles that enhances safety also leads to significantly higher repair costs.

- An increase in the severity of weather events, such as hail, is driving up premiums. For instance, hail-related auto claims accounted for 11.8% of all comprehensive claims in 2023.

- The rise in motor vehicle traffic fatalities is another concern. In 2023, an estimated 19,515 people died from traffic crashes, prompting higher insurance costs.

- Vehicle theft rates and congestion in urban areas are also contributors to increased premiums. Electric vehicles, now more common, cost approximately 46.9% more to repair than gas-powered cars.

States with the Highest Insurance Costs

Insurify analyzed the ten most expensive states for car insurance to identify the underlying factors affecting policyholders. Consumers in these states may see significant impacts on their financial health due to rising premiums.

States with the Cheapest Insurance Costs

Conversely, here are the states currently noted for having the cheapest car insurance, providing consumers with potentially lower financial burdens.

States with Rapidly Rising Insurance Rates

The reasons behind the extreme increases in rates in five states vary, yet shifting weather patterns and more frequent severe weather events are significant concerns. Additionally, states such as Minnesota, Missouri, and California are projected to see rate increases of over 50% in 2024.

Ways to Reduce Insurance Rates

The good news is that drivers can take proactive steps to lower their insurance rates. Here are several effective strategies:

- Shop around and compare rates from multiple providers to potentially lower your annual costs.

- Consider bundling home and car insurance policies to save money.

- Take advantage of discounts and usage-based insurance programs that reward safe driving behaviors.

- Increasing your deductible may also lower your premium.

- If you drive an older vehicle, you might consider dropping comprehensive and collision coverage.

- Opt into telematics programs, which can reward cautious driving with reduced costs.

As Betsy Stella, vice president of carrier management and operations, noted, “Generally, consumers will continue to see rates rise with inflation or in areas where traffic accidents are increasing, but in some states, they could see premiums decrease a little again.”