Thanks to high new car prices, low vehicle inventories, and elevated interest rates, drivers are increasingly avoiding trade-ins and upgrades. Consequently, a recent report by S&P Global Mobility reveals that the average age of passenger vehicles on U.S. roads has reached a new record in 2023.

Tough Market: Rising Car Prices and Production Delays

A report by Cox Auto Group illustrates that the U.S. new car market is progressively becoming a luxury market, where new vehicles are predominantly accessible to wealthier buyers. This shift can be attributed to supply disruptions, new technology, limited inventories, and rising interest rates, along with automakers focusing more on affluent purchasers.

In December 2017, Cox tracked 36 models with MSRPs (manufacturer’s suggested retail price) below $25,000, making up 13% of total new-vehicle sales. However, by December 2022, only 10 models with MSRPs under $25,000 remained on the market, reflecting a mere share of slightly under 4%.

Elevated Costs = Drivers Keep Vehicles Longer

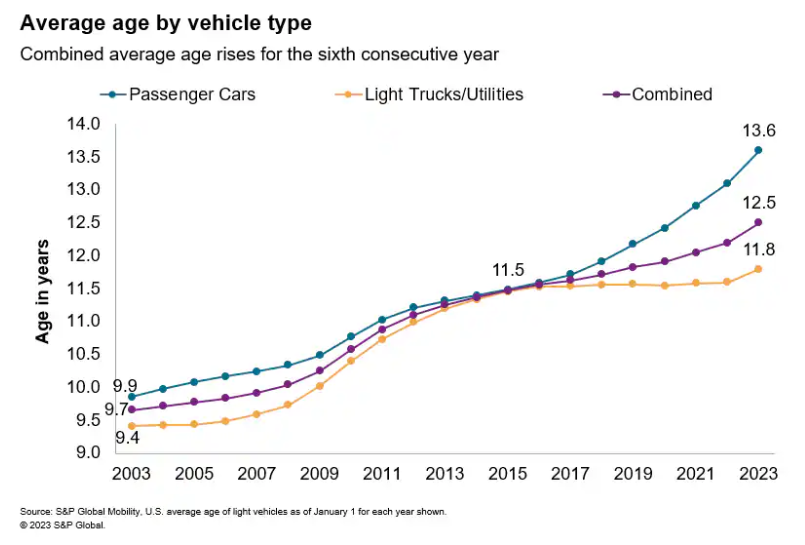

S&P Global’s report tracks the average age of over 284 million vehicles in operation on U.S. roads. The findings indicate that the average age of cars and light trucks in the U.S. has risen to a new record of 12.5 years, which is a significant increase of more than three months over the previous year’s high. Specifically, there’s been a 3.8% increase for passenger cars, reaching an average age of 13.6 years, and a 1.7% increase in trucks, SUVs, and crossovers to a new record of 11.8 years.

This trend correlates with disruptions in the new car market last year, when S&P Global accurately predicted that diminished new vehicle sales would raise the average age of vehicles on the road.

In 2022, the combination of slowed auto production and decreasing consumer demand led retail and fleet sales of new light vehicles in the U.S. to drop 8% from 2021’s 14.6 million units to 13.9 million units. This marks the lowest level recorded in over a decade, indicating that drivers are increasingly holding onto their vehicles longer.

Tips for Struggling New Car Buyers

As car manufacturers increasingly target the luxury sector, budget-conscious drivers should seek quality used cars that align better with their financial needs.

However, if you are determined to purchase a new vehicle, consider the following practical tips to alleviate the financial impact:

- Delay your new car purchase until later this year, as forecasts suggest the Federal Reserve may halt further interest rate hikes as inflation settles. Interest rates on new car loans are expected to stabilize, and may even decrease, which could alleviate costs.

- Compare car financing from various sources, including local banks, credit unions, and dealers. It’s crucial to explore the full range of options before settling on an initial offer.

- Focus on lower-priced vehicles with high resale value. Despite appealing features, luxury models tend to depreciate rapidly, which can negate any financing benefits.

- Opt for online purchasing. Major manufacturers, like Volvo, are shifting towards online sales, which can help reduce additional dealership fees and save you money.

- Evaluate electric vehicle options. The Inflation Reduction Act has enhanced the Electric Vehicle Tax Credit, allowing savings of $7,500 off the MSRP of an electric vehicle.

- If you are uncomfortable with traditional bargaining, consider non face-to-face communications such as email, text, or live chat, which can lead to more favorable deals.