By Ben Demers

More than 40 million student loan borrowers received a rude awakening when the Supreme Court struck down President Biden’s student loan forgiveness plan back in June. Those borrowers are now grappling with the reality of resuming their student loan payments as of October 1.

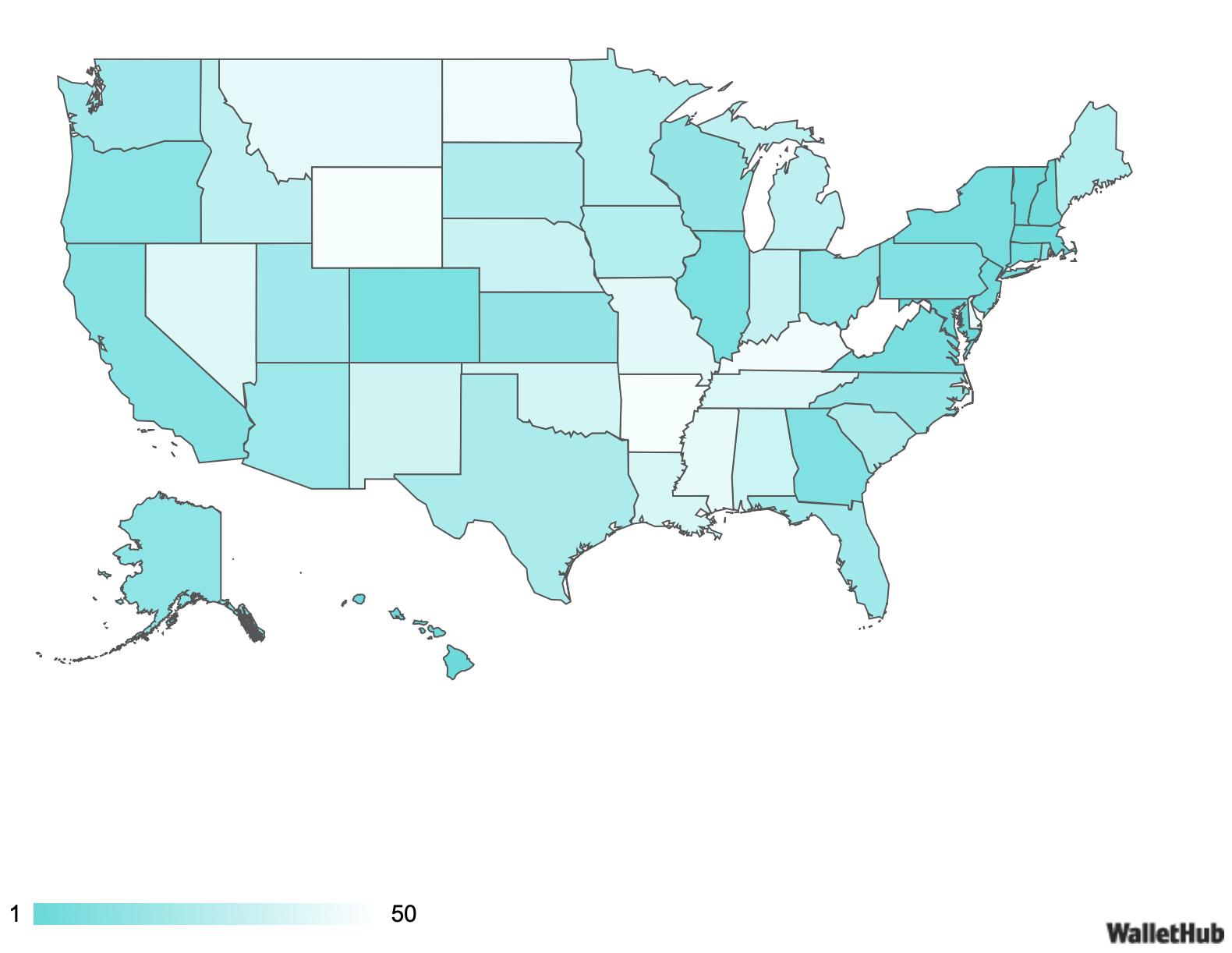

WalletHub’s new national student loan debt study reveals the states where the payment reality check is hitting the hardest, as well as those where borrowers are in much better shape.

Student Loan Debt, State by State

According to WalletHub, student loans are the largest component of Americans’ household debt after mortgages. Total college loan balances topped $1.64 trillion after the second quarter of 2023. This burden is spread unevenly throughout the country, however.

Student Loan Payment Rankings

WalletHub utilized its latest consumer finance data to rank all 50 states by median student loan payment per user, from highest to lowest. It’s notable that Washington, DC, was excluded from this ranking despite being included in previous editions.

The resulting state-by-state rankings show an unexpected array of outcomes, notably outside the general over-performance of states located to the west of Kansas.

Highest Student Debt Burden

The ten states likely to be hit hardest by the resumption of monthly student loan payments are clustered along the East Coast, with one Mountain and one Pacific state included.

| Overall Rank | State | Median Student Loan Payment |

| 1 | Maryland | $232/month |

| 2 | Vermont | $225 |

| 3 | Hawaii | $223 |

| 4 | Massachusetts | $222 |

| 5 | New Hampshire | $218 |

| 6 | Connecticut | $218 |

| 7 | New Jersey | $216 |

| 8 | New York | $212 |

| 9 | Virginia | $208 |

| 10 | Colorado | $207 |

Lowest Student Debt Burden

In contrast, the bottom ten states’ residents and economies are more equipped to handle the resumption of loan payments due to their lower burden of student debt.

| Overall Rank | State | Median Student Loan Payment |

| 41 | Nevada | $168/month |

| 42 | Missouri | $167 |

| 43 | Montana | $166 |

| 44 | Delaware | $166 |

| 45 | Mississippi | $163 |

| 46 | North Dakota | $160 |

| 47 | Kentucky | $159 |

| 48 | Arkansas | $158 |

| 49 | Wyoming | $158 |

| 50 | West Virginia | $139 |

Borrowers’ Best Next Moves

It is crucial to mention that these rankings only reflect the monthly payments going from borrowers to lenders nationwide. According to WalletHub’s data, many states mitigate their high median loan payments with numerous student loan grants and higher-paying job opportunities.

If you’re a borrower, ensure you have reviewed your loan details and made necessary financial adjustments. Now is the prime time to revisit your budget, evaluate repayment options, and implement other essential strategies to prepare for the expected financial impact.

Considering that 17 million borrower accounts have transitioned to new loan servicers or platforms since the loan pause began in 2020, it’s important to stay informed about your current situation.

By prioritizing your financial strategies, you’ll be in a strong position to navigate the resumption of student loan payments and any challenges that may arise.